Buy Now Pay Later's Predatory Takeover and Alternatives For E-Commerce Shoppers

Shopping can be tricky. You want that cool gadget or perfect outfit, but you're not sure that the quality of the product will hold up as advertised. Try Before You Buy (TBYB) is a new payment option that aims to address this. It's a cousin of Buy Now, Pay Later (BNPL), but with significant differences. Which one is actually better for your wallet?

Buy Now, Pay Later (BNPL): Convenience with Considerations

Here's a scenario you've probably found yourself in:

You're scrolling online, spot something you love, and voilà - Klarna, Affirm or Afterpay let you snag it right now and pay later. Sounds nifty, right? Well, it's a bit more nuanced than you might think.

BNPL is like that friend who always says, "Don't worry, you can pay me back later" - this seems great at first, but it can have serious consequences later on. Young shoppers especially love this option because it feels like magic: get the product now, stress about payment later.

The good news? Many BNPL services offer interest-free installments if you pay on time. The not-so-good news? It's super easy to go overboard.

The Good

Immediate Gratification

Consumers receive products upfront without full payment, enhancing shopping flexibility.

Interest-Free Periods

Many BNPL providers offer interest-free installments if payments are made on time, making it an attractive alternative to traditional credit cards.

The Bad

Overspending Risks

The ease of deferred payments can lead to purchasing beyond one’s means, potentially resulting in financial strain. A study highlighted by the Stanford Graduate School of Business found that BNPL users might face negative financial consequences, including overdraft charges and increased credit card interest.

If BNPL borrowers do not make the payments on time, they can incur late charges, overdraft fees, and interest payments. If they overuse BNPL, they may postpone other payments, incurring higher interest on credit cards and other kinds of loans.

- Theodore Kinni, "The Hidden Costs of Clicking the 'Buy Now, Pay Later' Button"

Credit Implications

Missed payments can adversely affect credit scores, and some BNPL services may report defaults to credit bureaus, impacting future borrowing capabilities. Consumer Reports notes that nonpayment can wind up on credit reports, significantly affecting credit scores.

Accumulation of Debt

Without stringent credit checks, consumers might accumulate multiple BNPL loans across different platforms, leading to unmanageable debt levels. The Consumer Financial Protection Bureau has raised concerns about the rapid increase in BNPL loans, emphasizing the need for consumer awareness regarding potential debt accumulation.

Total loan volume among the largest BNPL providers grew from $8.3 billion in 2020 to $24.2 billion in 2021, according to the Consumer Financial Protection Bureau. During the 2023 holiday season alone, shoppers availed themselves of $16.6 billion in BNPL loans.

- Theodore Kinni, "The Hidden Costs of Clicking the 'Buy Now, Pay Later' Button"

The Ugly

"We have plenty of evidence from history that, left to their own devices, the companies that issue credit tend to do so at consumers’ expense when they can."

- Ed deHaan, Professor of Accounting, Stanford Graduate School of Business

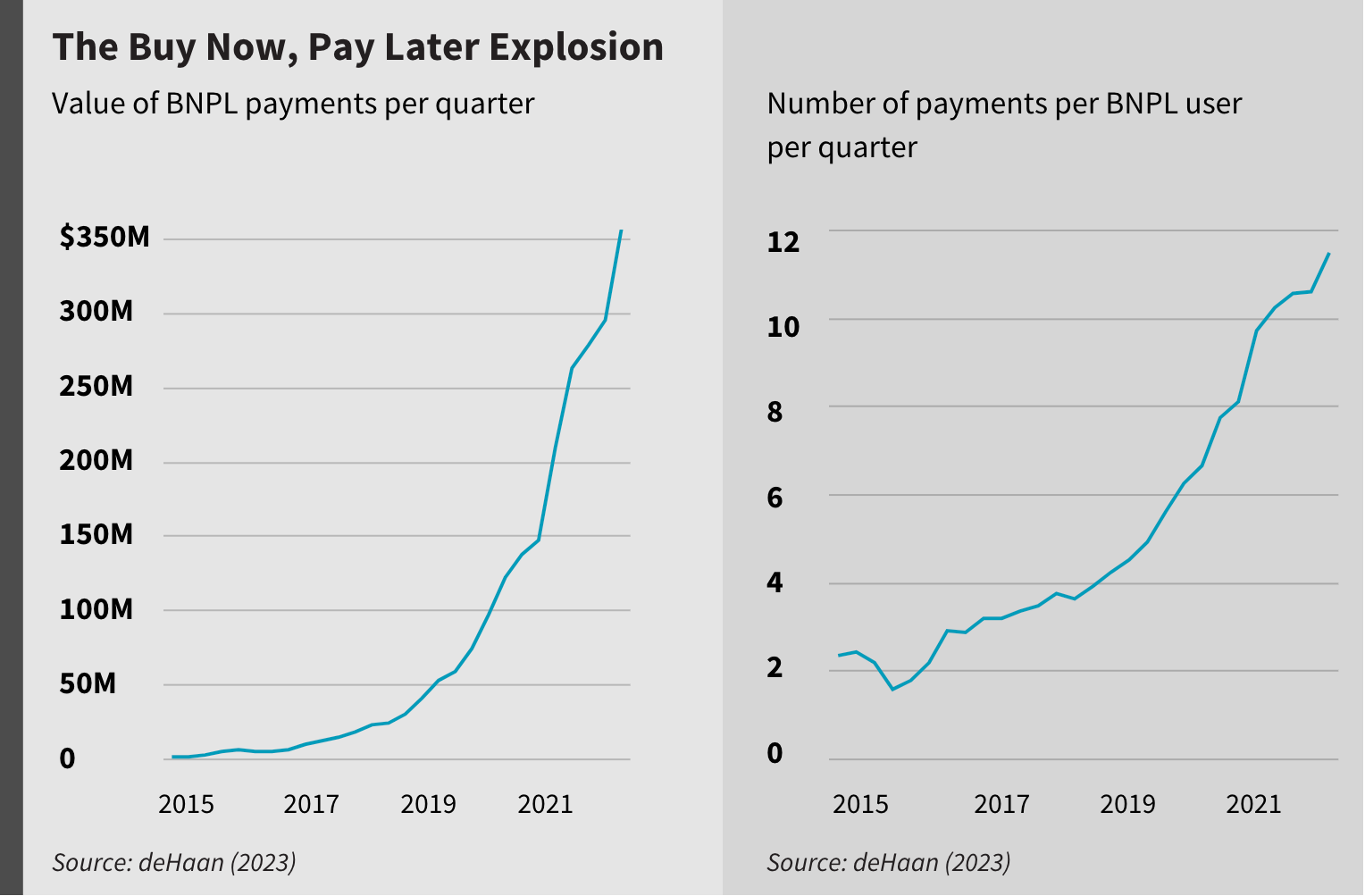

In the above graph, we can clearly see the penetration of BNPL into vulnerable consumers' lives. Not only has the total value of BNPL monthly payments exploded, but the number of BNPL loan payments per consumer has also skyrocketed. It's not hard to believe that once a user gets sucked into the temptation of free, flexible credit, they will end up abusing it.

In the actual study that Kinni highlights in his article, they found even more shocking statistics.

They analyzed the bank and credit card transactions of 10.6 million U.S. consumers between 2015 and 2021. They found that 13% had used BNPL. By 2021, the average borrower was paying $500 quarterly on a dozen BNPL installment payments.

- Theodore Kinni, "The Hidden Costs of Clicking the 'Buy Now, Pay Later' Button"

Taking the analysis a step further, the researchers found the ugly truth.

They found that being offered BNPL by a favorite retailer powerfully predicts a shopper’s willingness to use it and that these users had an 8.9% increase in overdraft charges, a 2.5% increase in credit card interest, and an 8.4% increase in late fees. This adds up to $176 per year in extra charges for the average user and up to $252 per year for especially vulnerable users.

- Theodore Kinni, "The Hidden Costs of Clicking the 'Buy Now, Pay Later' Button"

The conclusion? BNPL is not what it pretends to be.

“The average effect of using BNPL is negative, which is surprising. It’s a relatively small negative number, but likely meaningful for many people who live paycheck-to-paycheck."

- Ed deHaan, Professor of Accounting, Stanford Graduate School of Business

So who is to blame? Well, no one really. Smaller e-commerce merchants need a way to get customers in the door and providing flexible payment options allows them to do that. This is where alternative payment options like Try Before You Buy come in.

Try Before You Buy (TBYB): Assurance with Responsibility

TBYB programs enable consumers to test products at home before committing to a purchase. This model is prevalent in sectors like fashion and electronics, offering a tangible evaluation period.

Imagine ordering a jacket and actually getting to wear it at home before deciding if you want to keep it. No financial commitment upfront, just pure product testing.

"Try before you buy lets customers see and try products before making a purchase. Similar to how shoppers try on or test merchandise in-store, this order fulfillment option usually involves sending products to the customer so they can try before buying."

"Try before you buy is a win-win situation for both the brand and the customer."

- Shopify, "Try Before You Buy: How It Works With Examples (2024)"

Some of the biggest players in the game have been leveraging the TBYB model for quite some time now. Amazon first introduced TBYB when they launched Prime Wardrobe back in June of 2017.

Stitch Fix, a clothing subscription service also offered a similar model starting way back in 2011. They IPO'd on the Nasdaq stock exchange in 2017.

Casper has one of the most lenient TBYB programs with a 100-day trial period.

The list goes on as dozens of other brands are leading the way with this unconventional payment option.

Advantages

Informed Purchasing

Customers can assess products firsthand, reducing the likelihood of returns and enhancing satisfaction. Shopify explains that TBYB allows customers to try products in the convenience of their home before completing payment, leading to more informed decisions.

Financial Safety

Since payment is only required for kept items, consumers avoid the pitfalls of debt accumulation associated with deferred payment models.

Enhanced Trust

Offering TBYB can build consumer confidence, as it demonstrates a retailer’s commitment to customer satisfaction and product quality.

Considerations

Return Management

Consumers must adhere to return policies to avoid charges, necessitating timely decisions and actions.

Potential Fees

Some TBYB programs may charge fees for unreturned items or late returns, requiring consumers to be diligent about return deadlines.

At TryOnify, we've consistently seen significant increases in Sales Conversion Rates and Average Order Values when merchants implement TBYB as a payment option in their stores. We did a deep dive in a separate Case Study on how one of our client's skyrocketed conversions in just 5 days. More details on that can be found here.

Comparative Insights

Financial Impact

While BNPL facilitates immediate ownership with deferred payments, it's a slippery slope to financial overextension. In contrast, TBYB minimizes financial risk by requiring payment only for items the consumer decides to keep.

Consumer Experience

TBYB enhances the shopping experience by allowing product trials, leading to more deliberate purchasing decisions. BNPL, however, may encourage impulsive buying due to the allure of delayed payments.

Merchant Considerations

Retailers offering TBYB may experience increased customer satisfaction and reduced return rates, as customers are more certain about their purchases. However, they must manage the logistics of returns effectively. BNPL can boost sales volume but may also result in higher return rates and potential customer debt issues.

Conclusion

Both BNPL and TBYB present unique benefits and challenges. BNPL offers immediate product access with deferred payments, but plays into a long history of predatory banking towards lower income consumers. TBYB provides a risk-averse approach, allowing consumers to make informed decisions without immediate financial commitment. For e-commerce merchants seeking to balance convenience for consumers with fiscal responsibility, TBYB emerges as a compelling alternative, fostering responsible spending and enhancing overall satisfaction.

By understanding these payment options’ nuances, consumers and merchants can navigate the retail landscape more effectively, aligning purchasing and selling strategies with financial well-being and customer satisfaction.